The plaintiff claimed that on May 17, 2022, he was injured when he attempted to hold up his Harley Davidson motorcycle as it began falling over after he parked it on the unpaved driveway of the subject premises that he and his wife were leasing from our landlord client. Plaintiff argued that our client failed to repair or replace the unpaved driveway which he claimed was dangerous, defective, broken, unsafe, rocky and hard to navigate, and that the existence of a large rock and the unpaved condition of the driveway caused his motorcycle to become stuck and fall over. Our motion for summary judgment focused on the lack of any dangerous or defective conditions which proximately caused plaintiff’s accident, the lack of any notice to our client, and the absence of any prior reported accidents. In addition, we argued that plaintiff’s act of grabbing and attempting to hold the motorcycle up to stop it from falling over was the sole proximate cause of his injuries. In support, we presented to the Court testimony that neither plaintiff nor his wife made prior complaints about the driveway’s condition, and the specific rock claimed to have caused the accident, and that the alleged condition of the driveway was open and obvious and known to plaintiffs, who had resided at the premises for a year prior to the accident. In addition, we submitted affidavits from our clients attesting that while the driveway was not in aesthetically good condition, it was safe and functional and did not need to be replaced.

The Court agreed with our argument that the presence of rocks on the unpaved driveway, and the alleged tendency of the surface to become wet and “mushy” when it rained did not constitute unreasonably dangerous conditions, and was open and obvious and not inherently dangerous, and dismissed the complaint. Additionally, the Court ruled that the evidence in the case failed to support plaintiffs’ allegations that the alleged negligent maintenance of the subject driveway caused the plaintiff’s injuries.

The complaint was dismissed in its entirety. A demand of $2.4 million dollars had been made prior to the service of the motion.

At the time of the incident, the infant plaintiff and her mother were visiting a home owned by our clients who resided out of state. It was alleged the dog was owned by tenants of the property and that the dog bit the infant plaintiff causing substantial facial injuries. Plaintiff obtained a default judgment against the tenants. Our motion for summary judgement focused on our clients’ lack of knowledge that a dog was being harbored on the premises and that they neither knew nor should have known of any alleged vicious propensities. Deposition testimony was elicited by both plaintiffs and our clients that our clients were never made aware of the presence of a dog on their property. No prior incidents involving the dog were known and no prior complaints were received. As our clients testified at their depositions with the assistance of an interpreter, Wendy Schwartz elicited testimony from them clarifying their position in order to ensure that we were able to satisfy their burden of proof on the motion without the need for an affidavit.

The court adopted our arguments that in order to recover against a landlord for injuries caused by a tenants’ dog, plaintiffs had to demonstrate that (1) the landlord had notice that a dog was being harbored on the premises, (2) knew or should have known that the dog had vicious propensities and (3) had sufficient control of the premises to allow the landlord to remove or confine the dog. It was undisputed that our clients, as landlords, did not own the subject dog. It was also undisputed that plaintiffs and defendant landlords never communicated and neither side was aware of the presence of the other. After clearly demonstrating that both the dog’s presence at the premises as well as any prior alleged behavioral issues with the dog were unknown to our clients, the Court held plaintiffs failed to raise a triable issue of fact. The complaint against our clients was dismissed with prejudice.

On July 31, 2024 and after more than three weeks on trial and three days of jury deliberations before Judge Maldonado Cruz in Queens Supreme, Grant M. Meisels secured a $262,000 plaintiff’s verdict in a damages only motor vehicle case where the plaintiff’s pre-trial demand was $3,000,000 and asked the jury for more than $8,500,000. There was $6,000,000 of primary and excess insurance coverage to the insured truck driver and the company that owned the truck and summary judgment was already awarded against the defendants. The defendant truck driver hit the plaintiff in the rear while she was completely stopped but instinctively took post accident photos at the scene of both vehicles to show minimal damages to both the plaintiff’s vehicle and the defendant’s truck.

The 52 year old plaintiff, employed as a sterile technician at a local hospital, alleged a host of injuries that included bilateral knee surgical procedures, two bulging discs in the lumbar spine, a tear in the shoulder and an economic claim of more than $4,500,000 based on past and future loss of wages that included a claim she could never work again in any capacity and past and future medical expenses. Her argument at trial was that all of the injuries were causally related to the accident. The defense argued that all of the injuries were pre-existing and degenerative based on MRI films and she could return to work.

Plaintiff’s suggestion to the jury of an award of more than $8,500,000 was based on the testimony of her experts. Her suggestion included a claim of $2,000,000 for past pain and $2,000,000 for future pain. Her suggestions also included her life care planner calculations for $3,500,00 for the medicals and her economic calculations of $1,000,000 for loss of wages. The defense suggested $150,000 but only for past pain, past medical expenses and past loss of wages.

The verdict was significant for the defense as the jury award did not include any future money components and simply awarded $165,000 for 4 years of pain and suffering, $40,000 for medical expenses and $57,000 for past wages for 4 years.

Plaintiff called her treating orthopedist and her treating chiropractor and a life care planner and an economist.

The defense called an orthopedist, neuro-radiologist, vocational rehabilitation consultant and an economist.

Martin Rowe (partner) and Nadine Ibrahim (associate) secured a defense verdict on July 16, 2024, in the US District Court, Southern District of New York, before District Judge Gardephe in a disputed sideswipe trucking accident that occurred on the Cross Bronx Expressway.

As a result of the accident, the plaintiff injured his lumbar and cervical spine and underwent a lumbar discectomy at L3-L4 that was performed by Dr. Michael Gerling. Dr. Gerling testified at trial that the plaintiff would require lifetime medical care to his cervical and lumbar spine including pain management, physical therapy, annual diagnostic testing, a further lumbar discectomy and ultimately a lumbar fusion surgery. In his closing argument, the plaintiff’s counsel requested that the jury award $1.15 million in damages.

Our driver, smartly, took post-accident photos which depicted the final rest position of our truck and the plaintiff’s passenger vehicle. Based on Mr. Rowe’s strong cross examination of the plaintiff and direct of our driver, we were able to convince the jury that the plaintiff was attempting to overtake the insured’s truck while on the Cross Bronx Expressway and caused the accident. The defense verdict on liability was unanimous.

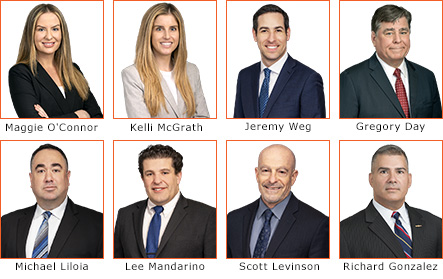

GVK is excited to announce the elevation of nine outstanding attorneys, Maggie O’Connor, Kelli McGrath, Jeremy Weg, Greg Day, Michael Liloia, Lee Mandarino, Sarah Allison, Scott Levinson and Richard Gonzalez to the position of Of Counsel. Their invaluable contributions and dedication to the firm’s client’s and success have made their promotion a well-deserved recognition of their accomplishments.

Maggie O’Connor concentrates her practice in defending clients in general liability, premises liability, labor law, motor vehicle, and property damage actions. Maggie has also successfully drafts and argues appeals in the New York State Appellate Division.

Kelli McGrath concentrates her practice in general litigation matters, including New York Labor Law, Construction Accidents, Construction Defects, Premises Liability and Products Liability. Throughout her career, Kelli has defended contractors, residential and commercial property owners, property tenants, real estate developers, hospitals, and insurance companies. Kelli handles cases in both Federal and State Court.

Jeremy Weg concentrates his practice in the areas of general liability, automotive liability, construction litigation, and premises liability. Jeremy has experience litigating medical malpractice and negligence claims involving hospitals, nursing homes, home care agencies, physicians, and other health care providers. He also has significant experience in claims involving general personal injury and motor vehicle accident litigation. Jeremy has written briefs and argued cases in the New York Appellate Divisions, First and Second Departments.

Gregory Day concentrates his practice in civil litigation including premises liability, labor law, transportation, product liability, subrogation, construction, property damage, wrongful death and contractual claims. With over twenty years of experience, Greg has argued appeals in the First and Second Departments of the NYS Appellate Division and has taken matters to verdict.

Michael Liloia concentrates his practice in representing automobile insurance and general liability coverage companies and their insureds in litigation involving claims of bodily injury, property damage, and coverage disputes. With nearly fifteen years of legal experience, Michael works diligently with clients in evaluating claims and communicating developments throughout the litigation process for an appropriate case-by-case cost-effective litigation strategy.

Lee Mandarino concentrates his practice in general liability defense, specifically in premises liability and motor vehicle accident cases, as well as insurance coverage matters. Detail-oriented and dedicated, he collaborates closely with his clients to effectively represent their interests and achieve their goals. Prior to joining Gallo Vitucci Klar LLP, Lee served as an associate with a prominent plaintiff’s personal injury law firm, where he skillfully guided injured parties through the complexities of the legal landscape.

Sarah Allison concentrates her practice in commercial insurance defense. Over that period of time, she has been recognized repeatedly as a Super Lawyer Rising Star. Her practice is primarily focused on premises liability and labor law matters though she has also handled motor vehicle cases. Sarah has successfully obtained case dismissals for her clients on both procedural and substantive grounds throughout her career with Gallo Vitucci Klar LLP.

Scott Levinson concentrates his practice in civil litigation, including premises liability, labor law, products liability, subrogation, property damage and contractual claims. With over thirty years of experience, Scott has represented a wide variety of corporate and individual clients at every level of litigation, from intake up to and including trials and appeals. He has served as Senior Trial Attorney for a large insurance carrier, was Of Counsel to a boutique insurance defense firm and developed and operated a successful multi-state law practice in New York and New Jersey.

Richard Gonzalez concentrates his practice in the firm’s Maritime and Admiralty Department. Richard previously worked in the firm’s Transportation Law Group and managed the firm’s No-Fault Department. Richard grew up in Puerto Rico from where he enlisted in the U.S. Coast Guard. While in the U.S. Coast Guard, Richard was involved in numerous operations afloat/underway and multiple large marine casualty/accident investigations, including but not limited to: vessel collisions and allisions, vessel groundings, passenger/crew personal injuries, port state control inspections, pollution investigations, suspension and revocation actions, merchant mariner licensing actions, and United States Coast Guard and National Transportation Safety Board investigations. Richard retired from active-duty service from the U.S. Coast Guard, having achieved the rank of Lieutenant Commander (LCDR).

Insurer Wins Unanimous Decision in New York Choice of Law Battle

In sports, there’s nothing like a clean sweep, a shutout, a perfect game or a unanimous decision. Anything close to a unanimous decision in the U.S Supreme Court these days is rare. Count a gritty marine insurer as part of the exclusive Supreme Court’s 9-0 club; winners by knockout in a hotly contested marine insurance dispute that braved its way from the District of Pennsylvania to the U.S. Court of Appeals for the Third Circuit and ultimately landed in the Supreme Court. And all the fuss was over the insurance contract’s selection of New York law to govern future disputes.

The financial stakes were not as high in the case as they were for the overall marine insurance market. Indeed, while the legal expense far exceeded the value of the claim, the tenacity of the marine insurer involved in digging in on a major principal of maritime law and not throwing in the towel, will turn out to be worth every penny for the future of marine insurance.

All the insurance company wanted was a fair fight, like any insurer involved in a disputed insurance coverage litigation. But the insured’s retaliation to a declaratory judgment action included extra-contractual counter claims for breach of fiduciary duty, insurance bad faith and breach of Pennsylvania’s Unfair Trade Practices Law. Such claims signal dangerous waters for an insurance company and often have the effect of trumping a fair assessment and adjudication of the claim itself. Faced with claims that could result in a shifting of attorney’s fees, treble damages and more, insurers typically settle rather than risk the pursuit of justice when such pursuit is not solely on the merits of the claim.

That all has changed for marine insurers since the Supreme Court’s unanimous decision on Feb. 21, 2024, to overturn the Third Circuit and enforce the insurance contract’s New York choice of law clause. Great Lakes Insurance SE v. Raiders Retreat Realty Company, 601 U.S. 65 (2024). The effect of enforcing the choice of law clause was to wipe out the state of Pennsylvania’s extra-contractual bad faith claims. This permits a resolution on the merits not clouded by the specter of bad faith and attorney’s fees.

Hitting Rock Bottom

Raiders Retreat (a Pennsylvania company) owned a yacht insured with Great Lakes Insurance for $550,000. The yacht ran hard aground in Florida waters, resulting in extensive hull and machinery damage. The United Kingdom-based marine insurer denied the claim citing alleged misrepresentations in statements by the insured prior to binding coverage and breach of express warranties contained within the policy.

The district court enforced the policy’s New York choice of law clause thereby sinking the extra-contractual claims sounding in Pennsylvania state law. Despite the insurance contract’s clear and unambiguous New York choice of law clause, the Third Circuit vacated and remanded permitting the district court to consider whether Pennsylvania state law has a ‘strong public policy’ to protect citizens insured in its state by applying its own state laws. 47 F.4th 225 (3d Cir. 2022).

With full appreciation of the significance of this ruling not only for the Great Lakes Insurance SE v. Raiders Retreat Realty Company case, but for the marine insurance market and maritime law as a whole, the insurer and its tenacious maritime coverage counsel, The Goldman Maritime Law Group, took an expensive gamble with a pitch to the Supreme Court. The thrust was to resolve once and for all a split in the Courts of Appeal regarding the enforceability of choice of law provisions in maritime contracts.

The decision authored by Justice Brett Kavanaugh concluded that choice of law provisions in maritime contracts are presumptively enforceable. The ruling is of utmost importance to the pursuit of uniformity in maritime laws throughout the United States as it will ‘reduce legal uncertainty’ and avoid a patchwork of marine insurance decisions throughout the 50 states. 601 U.S. *72, 77.

Bright Line Rule Adopted

As stated in the conclusion of my Admiralty Law column prior to oral argument, this would be the “Supreme Court’s opportunity to salvage a bright line federal rule permitting parties to a maritime contract to rely upon choice of law clauses that will be enforced by the courts. This is the only way to avoid parties running aground in mostly uncharted waters and laws of the 50 states…a federal maritime rule adopted by the Supreme Court will have the desired impact of promoting uniformity of law in this maritime nation”. (See, James E. Mercante, “Off to Sea the Wizard: High Court Takes on Marine Insurance Dispute”, New York Law Journal, April 19, 2023).

This is precisely what the court’s decision has accomplished. Having attended oral argument on behalf of the New York Law Journal, it was quite encouraging to hear nine Justices (none with maritime backgrounds to speak of) questioning and opining on intricate issues of maritime law and marine insurance history dating back six decades to the court’s last marine insurance dispute in Wilburn Boat v. Fireman’s Fund Insurance, 348 U.S. 310 (1955).

Justice Clarence Thomas was highly critical of Wilburn Boat in his concurring opinion and seemed eager to have the opportunity to reverse course on a decades old Supreme Court decision. Here, Thomas was adamant that Wilburn Boat was wrongly decided and reiterated that ‘uniformity’ and federal admiralty law requires strict compliance with express warranties in a marine policy. Similarly, under New York insurance law, a breach of warranty does not require a causal connection between the breach and the loss.

Judging Risk

A New York choice of law clause will be upheld according to the Supreme Court, unless the parties can “furnish no reasonable basis for the chosen jurisdiction.” 601 U.S. at *76. The court acknowledged that New York was a reasonable choice because its insurance law is well developed, well known and well regarded.

A choice of law clause enables the parties to a maritime contract to determine in advance (before a conflict arises) what law will govern a dispute, and in the case of a marine insurer, to better assess risk of exposure and the insurance premium to be charged. Thus, the Supreme Court’s decision is a giant step toward streamlining maritime contract disputes. It will avoid a tug-of-war over what law to apply when numerous jurisdictions are potentially implicated while providing a fair and unclouded judicial resolution on the merits of marine insurance litigation.

We are proud to announce that our attorney, Michael Stern, has been featured in the 16th edition of Millennium, A Marquis Who’s Who Magazine!

Michael Stern is an admiralty and insurance coverage attorney. He is a litigator with more than 30 years of experience representing cargo insurers, terminal operators, vessel owners, charterers and operators, the Protection & Indemnity Associations, recreational vessel owners and their insurers, marinas, domestic and international insurers, reinsurers, reinsurance intermediaries, and international commodities trading houses in a wide variety of contract and claim specific issues for which his guidance or counsel is sought. He maintains an active litigation and arbitration practice before federal, state, and international courts and arbitral bodies. He has considerable experience acting in conjunction with foreign attorneys in contested matters pending before courts and arbitral fora in countries, including England, Singapore and Japan.

See Michael’s feature here: https://marquismillennium.com/16th_Ed/278

Plaintiff was employed by GVK’s client when he was involved in a work-related accident while working on a project for Con Ed. During discovery, we established through document responses and deposition testimony there was no written agreement between plaintiff’s employer and Con Ed. Citing the lack of a contract or grave injury, we moved for summary judgment arguing Workers’ Compensation Law § 11 prohibited Con Ed’s third-party claims against GVK’s. Despite a $4.5M demand by plaintiff, Con Ed conceded its claims against GVK’s client lacked merit and voluntarily discontinued its third-party action.

One of our new practice areas with the addition of Bruce M. Friedman and his team from Rubin Fiorella Friedman & Mercante LLP, is a full-service reinsurance practice. Bruce is among the most experienced reinsurance practitioners in the country. Bruce’s bio may be found at the GVK website.

While reinsurance is far removed from the daily thought processes and operations of claim adjustors and defense counsel, the actions of those persons can have implications on the reinsurance collection process. The manner in which claim files are documented and maintained, settlements packaged and reported to reinsurers, and substantive reinsurance reporting, can all affect not only reinsurance recoveries but the speed with which reinsurance claims are paid.

Every insurance company purchases substantial reinsurance, both treaty and facultative, to protect its books of business and to enable the company to grow its premium base. While insurers and their reinsurers are in an active trading relationship, few disputes are likely to develop. However, there are always going to be principled disagreements relating to coverage. Opioid, other public nuisance, COVID, sexual misconduct and cyber claims, occurrence-related issues, and reinsurance contract interpretation, are driving the majority of current reinsurance disputes, while asbestos and environmental claims continue to drive disputes on legacy business.

Today, with insurers and reinsurers increasingly selling off their discontinued lines of business, companies now find themselves having to collect reinsurance from or pay reinsurance to companies with whom they did not enter into the reinsurance contracts. It is in this so-called “run-off” space that most of today’s reinsurance disputes are spawned.

Bruce and his team can be of assistance to GVK clients in many areas, including:

- Reinsurance collections in arbitration or litigation

- Abbreviated ADR processes where the amounts at issue do not justify the cost of traditional arbitration or litigation processes

- Enforcing security requirements in reinsurance contracts with non-admitted reinsurers

- Counseling claim staffs on file management

- Allocation of settlements where the underlying claim implicates multiple policy periods

- Managing bad faith, XPL and ECO exposures

- Analyzing contracts to verify insurance and reinsurance coverage

- Evaluating assumed reinsurance claims

Our clients may already be familiar with Bruce and his reinsurance practice capabilities. If not, we would appreciate the opportunity to introduce Bruce and his team to your ceded and/or assumed reinsurance staff.

On May 25, 2024, a federal court jury rendered a defense verdict following a week of trial concerning allegations that the defendant driver rear-ended plaintiff’s vehicle in a collision that occurred in the far left lane at the intersection of First avenue and 29th Street, Manhattan, in the early morning hours of January 20, 2022. Plaintiff claimed to have been rendered unconscious by the collision, and later sought treatment from pain management specialists, chiropractic care and acupuncture. He later underwent surgeries to both shoulders claiming that the accident caused various tears to his shoulder tendons.

Plaintiff claimed in addition that he sustained herniations to his cervical and lumbosacral discs from the collision. He attended roughly 1000 visits to various medical professionals and claimed at trial that none of the treatment provided-including serial injections-afforded him any relief from his unrelenting pain. Plaintiff claimed at trial that the accident caused him to retire from his job as a driver for United Cerebral Palsy and further alleged that his disability required his wife to provide care for him as a paid homecare attendant. He alleged that he was rendered unable to perform his activities of daily living and that his wife had to perform these functions for him, including dressing him and providing for all his daily needs.

On cross examination Mr. Vitucci brought to the jury’s attention that plaintiff had suffered from a stroke two years prior to his retirement and in fact had attributed his retirement to the stroke in a letter signed by him and contained in his employment file. The letter was written two years prior to the subject accident.

After ruling on objections, the court admitted the letter into evidence as a prior inconsistent statement.

Mr. Vitucci further had admitted into evidence photographs which directly contradicted plaintiff’s testimony that the accident involved a rear-end collision. Over objection the court allowed testimony of the defendant driver that his view of the photographs-which he took at the scene of the accident-showed that there was only driver’s side damage including openings to the sheet metal of the driver’s side doors which could only have come from the rotary action of the truck tire’s lug nuts on the tractor’s driver’s side front tire.

Mr. Vitucci elicited testimony from the defendant driver that it was plaintiff who caused the contact by driving into the front right of the defendant’s tractor by trying to pass him from right to left. The testimony elicited was supported by the vehicle damage photographs which appeared to show a sideswipe event occurring from back to front on the driver’s side of plaintiff’s Toyota Camry.

It was ultimately argued that despite counsel’s contention that the matter involved a violent collision occasioned by a loaded tractor trailer weighing in excess of 26,000 pounds- that what really was in issue was a sideswipe impact caused by the negligent actions of the plaintiff.

The experts called by Mr. Vitucci supported this conclusion. Both medical experts opined-supported by their exams of plaintiff and their reading of MRI’s taken of the allegedly injured body parts that what was shown in the films and their exams was a typical presentation of degenerative body pathology that would be common for any 63 year old such as the plaintiff with no evidence of trauma being identified in their view.

Mr. Vitucci sharply questioned plaintiff’s medical experts with an eye to establishing that there was no need for the surgeries plaintiff underwent a month following the collision, and that in addition there was no evidence of causal relation of the accident to the claims of spinal issues and their after -effects. Defendant’s neurosurgeon instead pointed to the obvious prior conditions caused by his stroke. Both took issue with the idea that any of the plaintiff’s subjective complaints were in any way the result of the subject collision.

Plaintiff requested in summation that the jury award his client 1.25 million dollars for past and future pain and suffering and medical expense. After several hours of deliberation, the jury returned a verdict in favor of the defendants finding that the defendant driver was not negligent in the happening of the accident.